Our Projects

Flagship Project

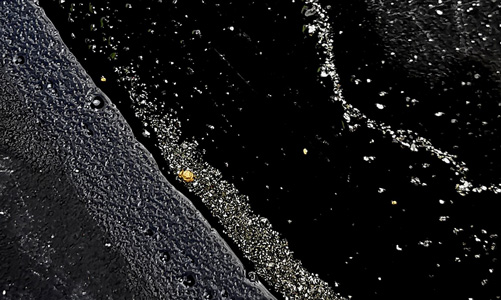

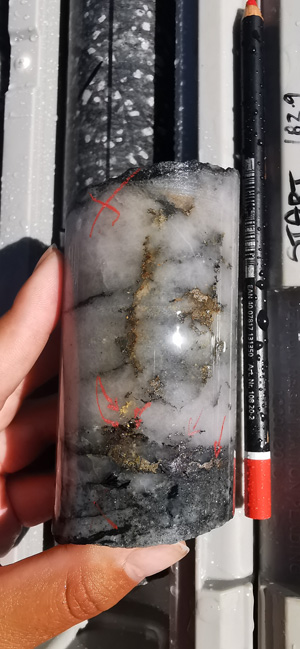

Mandilla Gold

The Mandilla Gold Project is situated in the northern Widgiemooltha greenstone belt in the western part of the Kalgoorlie geological domain, some 70 kilometres south of the significant mining centre of Kalgoorlie and 20 kilometres west of Kambalda in Western Australia.

The Project lies on the western margin of a porphyritic granitic intrusion known as the Emu Rocks Granite. The granite intrudes volcanoclastic sedimentary rocks in the project area which form part of the Spargoville Group.

Project

Feysville

The Feysville Project is located in Australia’s premier gold belt, just 14km south of the giant Golden Mile deposit (70Moz) at Kalgoorlie. The belt extends for some 100km along a NNW strike, and takes in major gold deposits at New Celebration (3Moz), some 10km south of Feysville, and the large St Ives field (+15Moz) 30 to 60km to the south. Numerous other economic gold deposits have also been discovered.

Project

Carnilya Hill

The Carnilya Hill Gold Project is located approximately 20 kilometres south-south-east of the Company’s Feysville Project and approximately 40 kilometres south-east of Kalgoorlie, Western Australia.

The Project encompasses various tenements – M26/047-049, M26/453 representing an aggregate area of approximately 2.65 square kilometres – with rights to nickel and other minerals held by Mincor Resources NL (ASX: MCR) (“Mincor”).